Covid-19 had a huge impact on most if not everyone in one form or another. For me amongst many things, Covid-19 really got me thinking about savings and investments with the key question being, “what will I do if I lost my job today”. I’m sure I’m not the only one that thought along those lines.

Fortunately for me, 2020 was also my 30th birthday! Like most 30 years old in a semi-life crisis, I decided to try a 10-year experiment starting on my 30th birthday.

In a few words “I will invest my age for the next 10 years”. This was the birth of ‘Invest my age’ the primary driver behind me starting this blog.

It goes like this.

At 30 years I will at a minimum invest £30,000

At 31 years I will at a minimum invest £31,000

At 32 years, I will at a minimum invest £32,000.

The keyword here is minimum, if I can save £50,000 at 30 years amazing I would but at a minimum, I will not default at investing my age for the next 10 years.

I know when you search for investing you find a wide range of advice from invest at least 20% of your income to invest at least 50-75% of your income with the FIRE movement. I also know when you search for investing your age you find solid advice on what percentage of your income should be invested in stocks. etc

While they are all rock-solid advice, and I’m totally in support of doing so, I set myself this ‘invest my age’ goal, so I don’t have to give myself excuses for when life events come.

My hope is that with this minimum target I at least will save a minimum of £30,000 for the next 10 years.

What If I Cannot Save My Age x 1,000?

When I have discussed my ‘save my age’ practice with friends, many of whom cannot invest their age I have advised them to invest half their age. For example, if you are 32 and cannot invest £32,000, you can aim to invest £16,000k.

The key thing is to set a minimum target and stick to it and I find this as an easy way to set a target.

I must admit that I daydream about where I would be if I started this at 25 but at the end of the day, it’s better to start now than tomorrow.

What Is The Average Savings By Age?

The average savings by age across most countries is sad and shocking.

In the UK, 40% of people aged 22-29years don’t have any savings. 10% have less than £3,000 saved and ,only 25% have more than £6,000 saved.

The average saving for those aged 18-24 is £2481, for those aged 25-34 is £3,544, for those aged 35-44 is £5,995 and, for those aged 45-54 is £11,013. Above 55 years of age, the average savings is £20,028.

In the US, the average savings by those age 35 and under is $11,200, for those aged 35 – 44 Is $27,900 and, for those aged 45-54 is $48,200. Above 55 years of age, the average American has saved $57,800.

If you manage to save your age or half your age, you are already doing better than over 85% of your mates.

Congratulations!

How To Hit The ‘Age’ Savings Target?

The easiest way I have achieved this target and aim to continue to do so is to restrict myself for the first couple of months it takes in the year to achieve the age target.

For me, this means since my 30th birthday was on 25th October 2020, from November, I started working double-time to save and make sure I have invested £31,000 by 25th October 2021.

I do this for two reasons

- The earlier I achieve the target, the sooner I get the goal off my back!

- Maybe, just maybe, I might be able to maintain that level of discipline and save more or double the saving.

As with all things, before you invest, make sure you have your runway sorted and saved. If Covid has taught me anything, it’s that the rainy day doesn’t always come with clouds, and you can never be overly prepared.

To Save or Invest?

When I say invest here, I mean invest = put the money to use not save in a bank account where inflation can easily wipe out your hard work.

Another good reason I invest money above my runway is that it forces me not to spend the money. I’m only human after all.

What Could ‘Invest My Age’ Look Like in 10 years?

If you only invested your age for the next 10 years, you are already a winner. According to statistics, only 25% of individuals aged 29 and below have over £6,000 saved, the majority are in debt.

Another win is off course all the money you will have saved. The final win is all the money you will have earned by investing your money. That my friends is what they call putting your money to work!

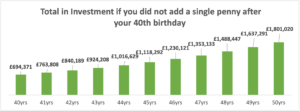

Here is what starting to save £30,000 at age 30 and continuing to save your age looks like in 10 years.

*The above assumes a conservative interest rate of 10% (S&P 500 average annual return since inception).

If you never add more to this investment after your 40th birthday at your 50th birthday you could have close to £2 Million.

Chances are, if you have invested your age consistently for 10 years from your 30th, you are unlikely to stop doing so by your 40th. You are most likely to be investing more.

It pays to start now.

In What Currency Should I Invest?

While I admit this might not seem like a reasonable question for most people. It was for me. I earn in British pounds sterling, and I did play around with the idea of investing in dollars. I figured I could reach the figure quicker. For example, at £1=$1,36, instead of investing £30,000 if I invested $30,000 then, it will only have cost me a little over £22,000.

While I am ashamed to admit this, the thought did cross my mind, but since I will be deceiving myself, I decided to do it in the currency I earn at.

Your income and expenses are relative to the currency in which you earn and spend them so you would not be doing yourself any good by switching currency. Also, except you are very good at mathematics, the forex rates and daily fluctuations will make the whole process even more difficult.

Having said that, depending on the strength of your local currency you might want to invest 10 times your age or 10 times your age. Just set your age goal and stick with it.

IN SUMMARY

In summary, you can either;

- Option 1 – Invest your age. If you are aged 35, set a goal to invest a minimum of £35000 or $35,000 (in the currency you earn) on your 35th birthday or before your 36th birthday.

- Option 2 – Invest half your age. If you are aged 35, set a goal to invest a minimum of half your age £17,500 or $17,500 (in the currency you earn) before your 36th birthday.

If your local currency makes all the 00s too easy, then invest 10 times or 20 times your age. You know what’s challenging for you, so do it.

*This is not financial advice. Do not consider this blog to be a substitute for obtaining advice from a qualified investment advisor. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional*