I can hardly believe it’s been a month since I made my first investment with Vanguard. you can read more on why I started investing with vanguard here.

I’ll be first to admit that I signed in to check on my investment every day in the first week and then like magic it stopped crossing my mind ever so often. I guess this is why vanguard doesn’t have an app, so they can make it’s easy for the investor to really invest for the long term.

Key Facts

Before we dive into how well (or not) my portfolio has performed, below is a quick factsheet about my investments.

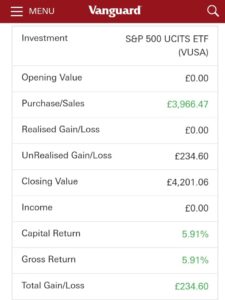

At the end of the process, I noticed I had £33.53 in cash and had in fact only invested £19,966.47. This is because I could only buy a whole unit/share on Vanguard. So, my £4,000 request for S&P 500 at a share price of £60.098 could only purchase 55 shares at a total cost of £3,966.47. Hence, £33.53 was returned in cash to my account.

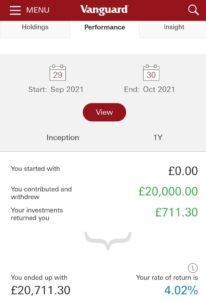

£19,966.47 invested returned £711.30 in Month 1.

Cost and Charges

Based on what I had invested in for every £10,000, I’ll incur an ongoing cost of £15 and a Fund Management Cost of £24.26. This means a total of £39.26 for every £10,000 invested in the five funds.

Risk Profile

Vanguard allocates a risk level to all investments. They call The Synthetic Risk and Reward Indicator (SRRI) and it measures the volatility of the fund.

The risk profile of my investments are;

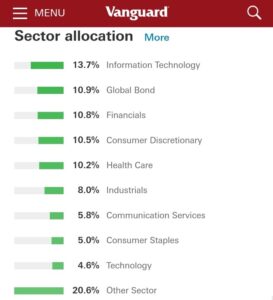

Top 10 Investment and Sector Allocation

My investment is weighted more towards the IT sector as expected. Interestingly enough I’ve got me some decent percentages of Microsoft Corp, Apple Inc and Alphabet Inc.

Product Type and Geographical Region

My investment is weighted more towards equity as I feel I am at an age where that is appropriate.

The majority of my investment is also in North America, Europe. and the UK.

I got very curious on why 22% is grouped in ‘other’ and did some digging to get more comfortable with it. You can find out more here

How My Portfolio Performed in Month 1

As at the end of October 2021, £19,966.47 invested has earned an impressive return of £711.30. A 4.02% rate of return in just one month.

Bearing in mind that the national average interest rate for savings accounts in the UK is 0.06% and the average interest rate for a cash ISA is 0.63% – I’m happy I’ve invested.

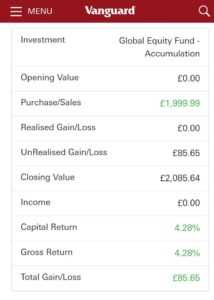

Each of my investment have each increased in the last month. Below is a summary of how each got of the 5 funds I invested in has performed.

What Will I Do Differently In Month 2?

I am happy with the funds I have invested in and have no plans to sell any of them.

However, it appears that the S&P 500 UCITS ETF has performed significantly better than all my other funds. I will keep an eye on it for the next month and probably consider buying more if it still stands out.

*This is not financial advice. Do not consider this blog to be a substitute for obtaining advice from a qualified investment advisor. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional*