It’s been 3 months since I began investing with Vanguard. You can read my previous post here where I share my journey setting up an account, picking my first set of investments and the performance after one year.

You can also read about my investment risk profile, sector allocation, and geographical spread of my investment in the same post.

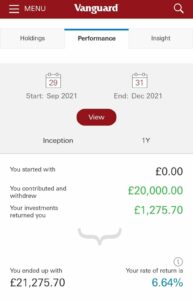

As at my last post, my initial investment of £19,966.47 had grown by £711.30 in just 30 days. I also stated that I wouldn’t add any more investment for the rest of 2021.

In this post, I will be sharing with you how that same investment of £19,966.47 has performed in the first quarter and what I will be doing differently in 2022.

£19,966.47 invested returned £1,275.70 in Quarter 1.

How My Portfolio Performed in Quarter 1

Within its first month, £19,966.47 invested has earned an impressive return of £711.30. A 4.02% rate of return in just one month.

Within a quarter, the same £19,966.47 invested has earned an impressive return of £1,275.70. A 6.64% rate of return in just one quarter.

Bearing in mind that the national average interest rate for savings accounts in the UK is 0.06% and the average interest rate for a cash ISA is 0.63% – I’m happy I’ve invested.

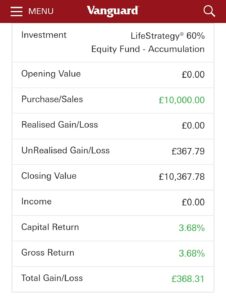

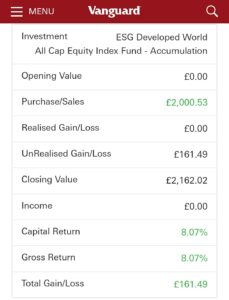

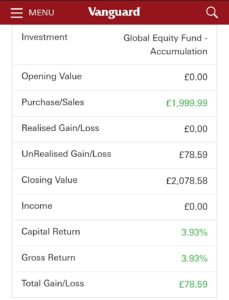

Each of my investment have each increased in the last month. Below is a summary of how each got of the 5 funds I invested in has performed.

What Will I Do Differently In Quarter 1 2022?

I am happy with the funds I have invested in and the overall performance of my investments.

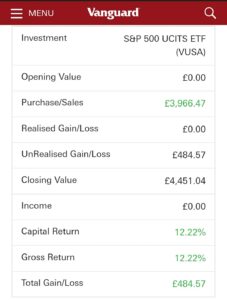

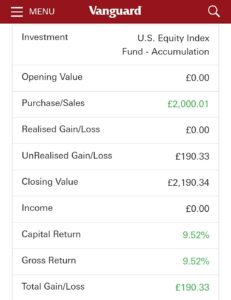

After this first quarter, it has become glaring that my S&P 500 UCITS ETF continues to perform significantly better than all my other funds. My S&P 500 UCITS ETF has returned 12.22% while, my next performing fund the U.S. Equity Index Fund has returned 9.52%. My lowest return is 3.68% from my investment in the LifeStrategy 60% Equity Fund.

If I could do it all again, I will swap the value I invested in LifeStrategy® 60% Equity Fund £10,000 with the £3,966.47 I invested in S&P 500 UCITS ETF.

The gain on my Global Equity Fund has also reduced slightly by £7.06 between the first month (£85.65) and this quarter (£78.59). Since the overall fund return is positive and I am investing for the long run, I am not at all bothered by the slight decline in gain.

My plan for the next quarter is to grow my investment in S&P 500 UCITS ETF through my Self Invested Pension Plan (SIPP) as I have maxed out my ISA tax free allowance and I still have £40,000 tax free allowance for my SIPP.

There is no need paying more taxes than you need to and I am a firm believer in maxing all tax free investment avenues before starting to put more into the general investment account.

If you are interested in investing with Vanguard, you can start here.

*I do not make a penny from you investing with Vanguard. I am simply sharing a good way of investing in index funds.*

*This is not financial advice. Do not consider this blog to be a substitute for obtaining advice from a qualified investment advisor. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional *